Which are the best instant mobile money loans in Zambia?

We can agree that our nation's economic situation makes it hard for an average Zambian to access a decent amount of funds for different purposes; food, school fees, rentals, and capital for small businesses.

Instant mobile money loans have come to solve these problems.

Despite offering small amounts of money to customers, instant mobile money loans have shown tremendous financial relief to many beneficiaries.

There are times you need money urgently but no one is willing to help. With instant loan services, people can sort out issues that are money-dependent.

Apply for K20,000 and get a K250 bonus use get civil servant loans now

ney account.

To get these soft loans you don't have to

Especially from the year 2022, there has been an influx of instant mobile money loans from different institutions.

The loans are given faster within minutes through various mobile money platforms available in Zambia.

To make life even more fun these lending platforms do not need a folder of personal details and files all you need in most cases are NRC and your residential address.

Some of them like Nasova, offer loans instantly using the information submitted to your telecommunications company. No need to provide a national registration card photo.

Best instant mobile money loans in Zambia

There are so many instant loan providers in Zambia. The best of all times will be those that have low interest rates and utilize mobile money services to serve customers, with no need to travel to their offices.

Just a phone call and a few questions you must be able to get financial help.

Here are common trusted mobile money loans providers in Zambia:

1. Nasova Loans Airtel Zambia

Airtel Zambia is a telecom company well known for offering mobile services including mobile money.

They offer instant loans and it seems there are third-party institutions that partnered with Airtel to provide instant loans to Airtel customers.

The interest rate is low and manageable for an average person.

The one drawback is that they do not offer a large amount of loans maybe because they don't want to risk huge sums of money to bad debtors.

Note that companies working with Airtel Money use the USSD code *115# and choose option 5 to access.

The prominent parties working with Airtel Zambia include the following:

ZedFine loan

the most reliable and easy platform to get an instant loan from using Airtel mobile money.

All you do is dial *115# and choose 5- Nasova loans then choose a numeral against ZedFine.

They give a maximum of K200 for first-time qualifying customers. Usually, you pay back k240 in 30 days of loan tenure.

KaFast loan

KaFast also is another great provider of small loans working through Airtel Zambia. They give up to K250 and pay back K292 at the end of 30 days.

The good part with them is that you pay using the same mobile money account that received the money.

No struggle to look for the bank account of the company.

Jumo Fixacash.

Jumo is an old partner to this telecom operating closer to 7 years now.

They have fair rates on interest and give larger amounts of loans to customers depending on your payment history and consistency.

Some customers can qualify for K1000 and above. collect a loan and pay in time to qualify for a larger amount next time you want to get one.

MFZ loans.

Also working with Airtel, they are a bit strict and may not give you anything till you meet their criteria.

2. BIU money

Biu Money Zambia Limited is a company that gives larger amounts of instant loans through your mobile money account.

It seems they are offering loans only to government workers so far.

They do not need a lot of data to offer you the service, and you receive it instantly in your mobile account.

BIU money interest rate is a little bit higher than others.

Not sure if they take advantage of the fact that they have access to civil servants' accounts or something.

Generally, BIU money is a great option if you want fast money to solve your financial wahala.

To get money from BIU, use this link, follow the instructions, and check your mobile money account.

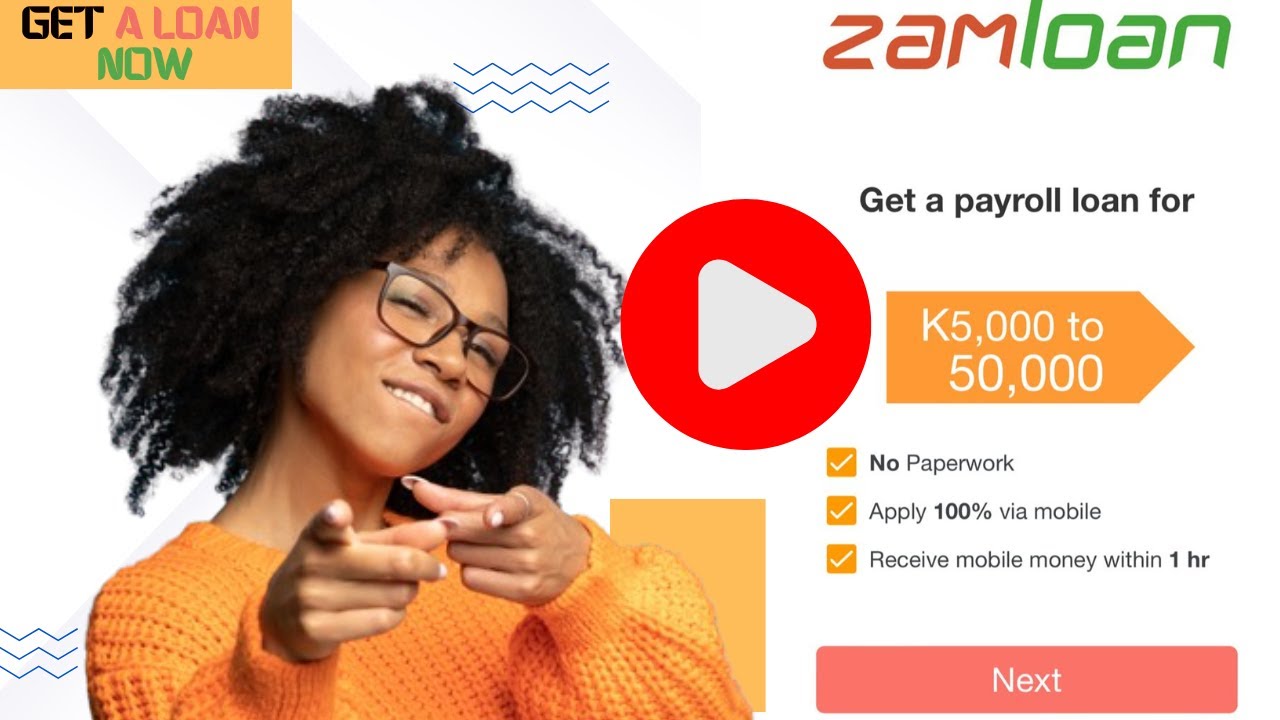

3. Zamloan.

The sister to BIU money is at a higher level when it comes to giving out loans. instant and easy.

They give larger amounts of money up to K50,000 with a tenure of up to 24 to 36 months.

The more you get the more your chances to qualify for larger amounts.

Mostly if you have been dealing with BIU money and have no negative issues you must be sure that you will get money from Zamloan.

4. Mwachangu.

They give anyone who meets the criteria for the loans. They give from as low as K200 up to K5000.

The problem is they are difficult in their criteria to qualify for the loan.

5. Rapid loans.

Also, another independent platform that gives loans instantly but gives small amounts even if Rapid Loans Pro claims to offer larger ones.

They are rare in providing big money only to some individuals with records.

6. Eazyloans Zambia.

A new platform not much information is provided by the company but they give loans from K500 to K20,000.

Try them you may be a luck customer testing the newcomer in the market. They also send money to your mobile account.

7. Yatu quick loans

A new instant mobile money loan provider in Zambia that is quicker at giving you cash.

They are faster at it and give you feedback about your loan application. to get money start from here

8. Fair loans

Get a loan from K250 to K5000. No paperwork instantly into your mobile money within Zambia.

9. Flashloan

Another great company that is instant at giving cash of up to K2500. get the loan app

10. Iseni loans

If you are looking for easy and cheap loans within Zambia these are the best.

You sign up this minute the next you get your money in your mobile account.

11. Power kwacha

A professional mobile money app Zambian owned for Zambians. Apply and remove your financial stress

12. Cash lender

Get personal loans of up to K10000. They are instant and have low interest rates.

13. Soft loans

Soft loans for your quick financing.

14. Best loan

Shopping is made easy in Zambia. Loans are easy to get instantly and cheap straight to your mobile money account.

15. Tandiza finance

If you need help with cash that is to be paid afterwards Tandiza loans are there for you. Just download their app now

16. Cash now loans

Personal loans of up to K6500. Get started and download the app to apply for your cash.

17. Quick loans.

Quickly get money and use it the way you want. Enjoy unlimited life anywhere and with whom you want.

Download the app for instant mobile money loans in Zambia

18. Zash instant loans

For instant and quick loans into your mobile money choose Zash, they are good and excellent customer care.

19. Prime loans

For small loans to buy items such as Zesco units and enjoy your weekend, Prime loans are the best.

20. CashGo mobile loans

Get a mobile app and apply for a loan of up to K5200 if you have a good credit score.

21. Credit cash

Borrow money from Credit cash. They offer instant mobile money loans in Zambia as long as you are connected to one of the telecoms and your sim is active.

22. FairMonney instant loan

You can afford your dream life through instant mobile money loans offered by Fairmoney. They are good and pay instantly.

23. EaseMoney- instant loans online

Learn how to be honest and pay low interest rates with this company. They are Zambia's trusted mobile loan app. Most customers are happy with them. Get a personal loan from bank

24. Zima cash instant mobile money loans

Not Zamchash, this is Zama cash. They are primarily a good start for quick personal loans in Zambia.

How to qualify for instant mobile money loans?

As you may know, money lenders do not give money to any Jim and Jack who calls them.

They have criteria in which sometimes known to themselves only.

However, with many clues and tips available I should be able to provide you with the things these instant loans givers are looking for.

:max_bytes(150000):strip_icc()/bankemployeewithcustomer-7ce1fdf243c343dc9d53a1a87e90caf5.jpeg)

1. Credit score.

If you failed to pay your previous loans the instant mobile money loans provider will take it that you are a bad borrower.

You are most likely also not to pay back with them. In such cases, they will give you silly excuses such as your mobile is not registered with a mobile money service or something, not that sounds funny.

Pay back your debts and apply for instant loans.

2. Your own phone number is registered in your name.

People have a tendency to borrow money using a SIM card not in their name so they can easily fool the money lenders, the thing is they at least have information available for that.

That is why telecommunications companies emphasize everyone to use the number that is registered in their own details. It's about dealing with trustworthy customers who consider giving out loans.

3. You are 18 years old and above

Being 18 years of age and above is one of the legal standards for collecting loans from companies.

If you are below 18 then things may not work the way you anticipated.

They want individuals who are responsible and understand the economic uncertainties of the country.

4. Your mobile number is at least 6 months old.

They presume you have several mobile money transactions that is, withdrawals, transfers, and receiving if you have been using your SIM card for more than 6 months.

Do as many transactions as you can to qualify for instant mobile money loans.

5. You have no fraud records on your mobile money number.

Those numbers associated with criminal records may end up being penalized by ZICTA.

Do not use a phone number that was used for fraudulent activities, not only will you not qualify to get loans but also get prosecuted accordingly.

Advantages of instant loans providers

Generally, they are a great platform since they give you money when you need it.

Unlike banks that make you wait till the day, they feel like having it credited to your account.

Truly speaking when a person thinks about money it means they want it at that time or soon later. These instant mobile money loans givers do just that.

- They are easy to go with, do not ask for a bunch of personal documents signed from different offices with a lot of movements like what banks do.

- They generally have lower interest rates than banks

- They do not get affected by changes in lending rates by the Bank of Zambia's monetary policy.

- They are instant in providing service.

Summary

If you are looking for fast money with no dram of paperwork then instant mobile money loans are your pick.

Look for the one that best suits your needs in terms of the amount they offer and how many days you are required to pay back.

They are flexible some of them. The list is above check and apply, then enjoy your money in any way you want to.

Share the Best Instant mobile money loans in Zambia and show care for your friends.

Related.